Swiss economy – Overview

Switzerland is one of the most competitive economies in the world, in large part thanks to its flourishing service sector. By international standards public debt in Switzerland is low, and the country has a competitive tax system. Small and medium-sized enterprises (SMEs) are the mainstay of the export-driven Swiss economy. The European Union (EU) is Switzerland's main trading partner.

Switzerland's comparatively low level of public debt, even during the COVID-19 pandemic, has been achieved by imposing a debt brake, i.e. a cap on public spending. The Swiss tax system reflects the country's federal structure. Competitive corporate tax rates set by the cantons make Switzerland an attractive location for companies. Switzerland has several other distinct advantages including a well-trained workforce, considerable innovative capacity, political stability, a high standard of living and its location at the centre of Europe. For all these reasons, a number of multinationals are based in Switzerland.

However, SMEs are the lifeblood of the Swiss economy. Many of these companies are export-driven, which is why Switzerland habitually runs a trade surplus.

Swiss economy - Facts and Figures

- Switzerland is one of the top 10 economies by GDP per capita ranking (USD 92,000 in 2022).

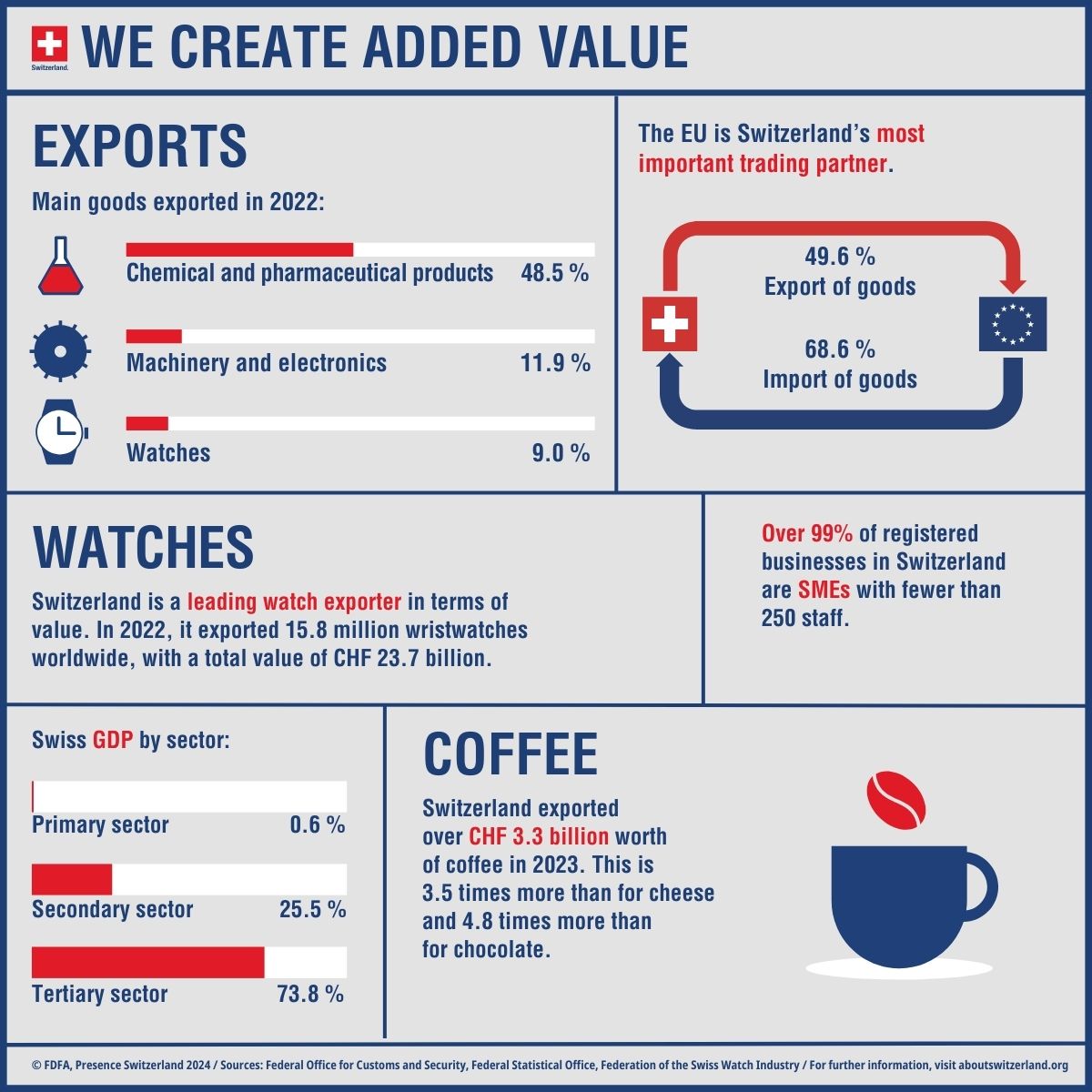

- Approximately 74% of Swiss GDP is generated by the services sector and 25% by industry. The agricultural sector contributes less than 1%.

- The European Union is Switzerland's main trading partner. Around 69% of Swiss imports are from the EU, while 50% of Swiss exports are to EU countries.

- The vast majority of Swiss businesses (over 99%) are SMEs employing fewer than 250 staff.

- Switzerland has maintained a low level of public debt relative to other countries even during the COVID-19 crisis. Aligned with the International Monetary Fund's Government Finance Statistics framework, gross public debt was around CHF 305 billion in 2023, or about 38% of GDP.

- Switzerland has one of the lowest rates of VAT in Europe. VAT at a rate of 8.1% is payable on most goods and services. A reduced rate of 3.8% is levied on accommodation services, while 2.6% applies to everyday items.

- Switzerland spends approximately CHF 25 billion on research and development (R&D) annually, which equates to around 3.4% of GDP. The private sector contributes over two thirds of this amount.

- The currency of Switzerland is the Swiss franc. The franc is divided into 100 centimes. The currency code for the Swiss franc is CHF.

Links

For more on this see

Public Finances

Public finances have been in surplus for some years now, while government debt remains relatively low.

Taxation

Taxes in Switzerland are relatively low and rates vary from canton to canton and from commune to commune.

Business

SMEs, the majority family-run firms, account for 99% of businesses operating in Switzerland. But Switzerland is also home to a large number of multinationals.

Exports and imports

The Swiss economy is driven by exports and imports, with Germany as Switzerland's number one trading partner.

Research and Development

Switzerland is one of the top ten R&D investors in the world, spending over 3% of total GDP.